The Royal Dutch Shell share price popped by more than 3%, becoming one of the best performers in the FTSE 100 index. The RDSB stock rose to 1,477p, which was substantially higher than this week’s low of 1,415p.

Why is RDSB share price rallying?

Shell is one of the biggest oil and gas companies in the world. It has operations globally. The stock is rising today after the company announced that it would receive $9.5 billion from ConocoPhillips. The company sold its Permian basin in cash, making it one of the biggest deals in the energy sector this year.

The Shell share price rose because the deal will see the company’s shareholders receive about $7 billion in form of a dividend and buybacks. It will use the remaining $2.5 billion to boost its balance sheet. Also, this transaction is a highly profitable one considering that Shell bought it in 2012 for $1.9 billion.

At the same time, Shell will benefit by reducing its carbon footprint. A few months ago, the company received a major setback when a Dutch court ordered it to slash its carbon emissions by 50% in the next few years. Shell is appealing the decision.

Meanwhile, the RDSB share price is rising because of the company’s role in the natural gas industry. As the biggest natural gas producer, the company is set to benefit now that the price has jumped substantially recently. Shell also has a strong dividend yield and is one of the most profitable oil majors.

Shell share price forecast

In my previous Shell share price forecast, I noted that the stock would soon rebound, helped by the company’s exposure in the oil and gas industry. While it is too early to tell, this production was right.

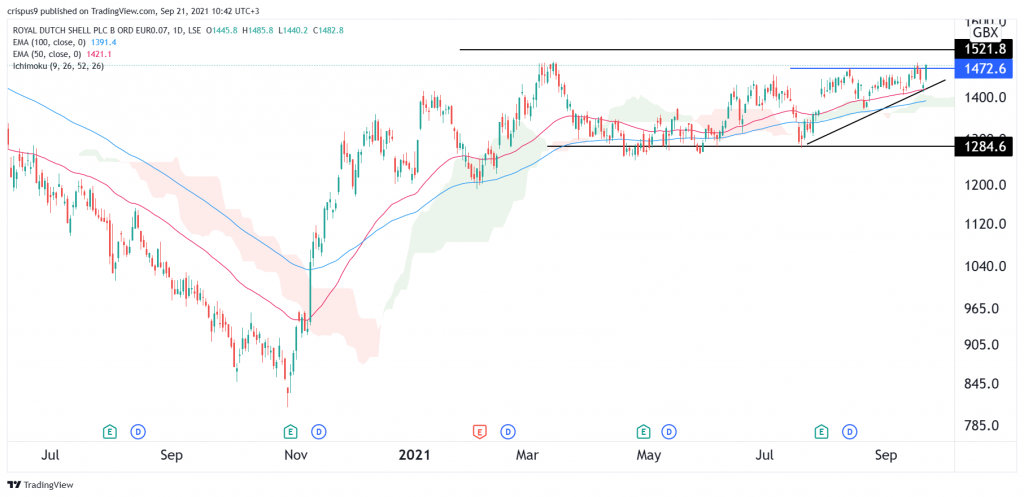

On the daily chart, the stock has remained above the 100-day and 50-day exponential moving averages (EMA) and above the Ichimoku cloud. It also rose above the key resistance at 1,472p, which was the highest level since August.

Therefore, the stock will likely keep rising as bulls target the key resistance at 1,500p. On the flip side, a drop below 1,400p will invalidate the bullish view.