The HSBC share price has jumped in the past two consecutive days as the Evergrande crisis ease. The stock is trading at 379p, which is significantly higher than this week’s low of 358p. Other UK banking groups like NatWest and Standard Chartered have also rebounded.

HSBC and Evergrande

HSBC is one of the biggest banks listed in London. Indeed, it is the biggest bank in Europe by assets. However, unlike many banks like NatWest and Lloyds, HSBC makes most of its money in the Asian market.

In particular, it has a strong presence in places like mainland China and Hong Kong. Indeed, the company has been focusing on the Asian market recently such that it has transferred most of its executives from London to Hong Kong. It has also decided to exit its business in places like France and the US in a bid to grow its wealth management products in the country.

Therefore, the HSBC share price has been under pressure in the past few months. Indeed, it has collapsed by more than 16% from its highest level this year.

It is clear to see why. First, the Chinese government has been in a major crackdown in the past few months. The focus of this crackdown has been in the technology and education sectors. This has seen the share prices of most technology companies like Tencent, Meituan, and Alibaba decline sharply.

Therefore, investors have worried about whether the financial sector is the next industry to face this crackdown, At the same time, the Chinese government policy of common prosperity will likely affect its wealth management solutions.

Evergrande is another key issue facing HSBC. As the company faces a collapse, investors are worried about the risks posed to companies like HSBC that holds its debt. Also, HSBC is a banker to many of the company’s customers and suppliers.

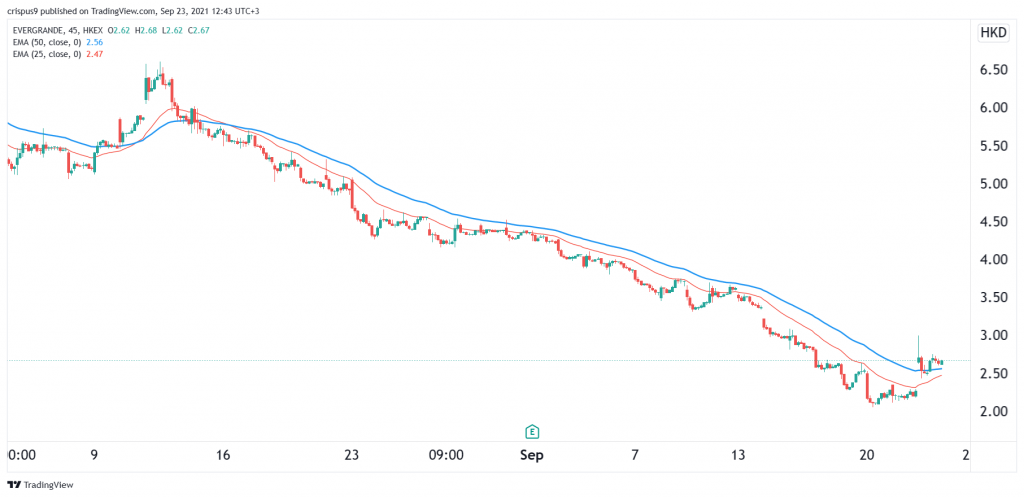

Therefore, the HSBC share price jumped today because investors are getting optimistic about Evergrande. It recently said that it will be able to pay its onshore bonds on Thursday. And there are hopes that it will reach a restructuring deal. As shown below, the Evergrande share price popped today.

HSBC share price forecast

The daily chart shows that the HSBC share price has jumped in the past two straight days. This rally has pushed its share price above the 50% Fibonacci retracement level. Still, it has found a lot of resistance below the 50-day and 25-day moving averages (MA) and 383p. This was an important level because it was the lowest level on July 16.

So, for now, HSBC is a relatively risky stock to invest in and there is a likelihood that it will remain being under pressure. As such, the bearish trend will remain so long as it is below the 50-day EMA.