The Tullow Oil share price erased some of the gains made earlier this week when the FTSE 250 company published its half-year results. The TLW stock is trading at 44.67p, which was slightly below this week’s high of 49p. It is also the most actively traded stock in London according to data compiled by Hargreaves Lansdown.

TLW returns to profitability

The biggest news of the week was that Tullow Oil had managed to return to profitability helped by the relatively higher oil prices. In a statement, the company said that it averaged about 61,230 barrels per day, in line with expectations. This, in turn, led to revenue of $727 million and a gross profit of more than $321 million. As a result, the company made an after-tax profit of more than $93 million. In a statement, the CEO said:

“Our West Africa production assets have performed well, and we are narrowing production guidance for 2021 to the upper end of the range. In Kenya, the revised development plan creates a robust project that has the potential to deliver material value to the Government of Kenya and other stakeholders.”

Tullow Oil, like other oil and gas companies, has benefited from the relatively higher oil prices. Indeed, the price of crude oil has jumped by more than 40% to more than $70. This is a remarkable performance considering that Brent declined to below $15 in 2020 while West Texas Intermediate (WTI) fell to minus $8.

This trend will likely continue judging by the recent reports by the International Energy Agency (IEA) and OPEC. In their reports this week, the two agencies predicted that oil demand will likely go back above pre-pandemic levels in 2022. The EIA estimated that the global demand will rise to 100.8 million barrels, above the 2019 average of 100.3.

Therefore, if OPEC+ maintains a gradual pace of supply increases, there is a likelihood that oil prices will keep rising in the near future. This, together with progress in Kenya, will help support the Tullow Oil share price.

Tullow Oil share price forecast

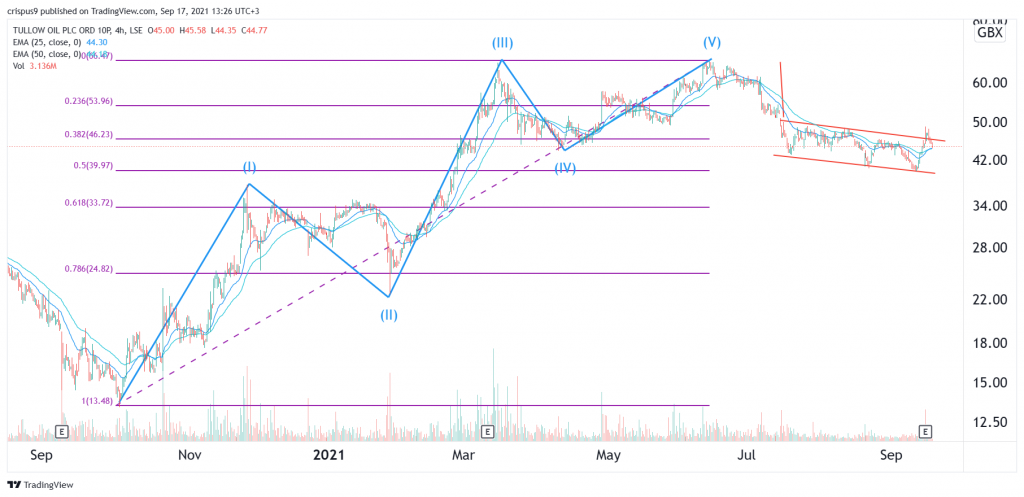

The four-hour chart shows several things about the TLW share price. First, the stock has already completed the formation of the impulse Elliot wave. Second, it has declined below the 38.2% Fibonacci retracement level at 46p. Third, the shares have moved below the 25-day and 50-day moving averages. Notably, it seems like it has formed a double-top and bearish flag pattern.

Therefore, while the overall trend is bullish, there is a likelihood that the stock will break out lower below 40p in the near term. On the flip side, a jump above 50p will invalidate the bearish view.